Have you ever wondered how excise tax might affect you as a consumer? It involves the cost you pay for different goods directly for many other products; for example, the government’s raising of excise taxes on fuel results in increased transportation expenses, which might drive higher pricing.

Therefore, understanding excise tax is very important now. In this blog, we shall understand its meaning, importance, and some examples. By the end, you’ll have learned about excise taxes and how they affect you.

In this blog, I’ll provide basic knowledge about this tax. You’ll learn about its meaning, importance, and some examples. By the end, you’ll have learned about excise taxes and how they affect you.

What is Excise Tax?

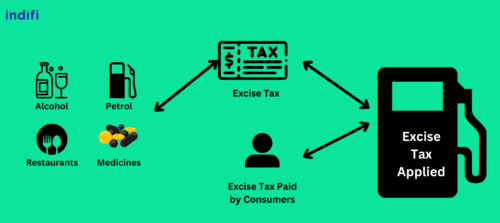

Excise duty meaning is the indirect taxes the government imposes on specific goods and services. They are levied to prevent the consumption of certain goods, fund government initiatives for societal benefit, and generate revenues. Contrary to sales tax, excise duty is limited to specific goods. Among these products are alcohol, cigarettes, motor fuel, and other expensive items. However, manufacturers or producers of goods pay their excise taxes upfront.

Do you know that now you can easily comply with GST by using GST Prime Software.

Importance of Excise Taxes

You might wonder how something that increases prices for goods and services can be important. But actually, it holds good importance. So, let’s talk about them briefly.

Revenue Generation

Without money, governments cannot function well, and excise taxes provide for a large portion of that revenue. Important services like healthcare, education, and infrastructure are paid for by this revenue; without it, governments would struggle to provide them. Here are few powerful strategies to boost revenues in restaurant industry.

Influencing Action

Excise taxes are a tool for social control. By raising the price of dangerous goods like alcohol and cigarettes, these levies can deter consumers from purchasing them. This raises the standard of public health. Fewer people drinking alcohol and smoking results in fewer health issues.

Fairness and Equity

Excise taxes make taxation more equitable. For instance, premium cars and yachts are subject to luxury taxes. This guarantees that higher-income earners pay higher taxes, distributing the tax burden among various income levels. Get rid of tax burden by finding top tax planning strategies for SMEs.

Funding Particular Programmes

Excise taxes frequently fund programs. Petrol taxes, for example, support transport and road upkeep, which translates into better highways for everyone. Alcohol and tobacco taxes can support programs for addiction treatment and public health.

Environment Protection

Excise taxes also help safeguard the environment. Taxes on carbon emissions and environmentally harmful products like plastic bags encourage greener behaviors and reduced pollution. Setting up a green business is one among the trendy niches here are few robust environment friendly business ideas that you can start easily.

Examples of Excise Duty

- Alcohol

- Tobacco

- Hotel rooms

- Parking garage tickets

- Health insurance plans

- Firearms

- Medical devices

- Restaurant services

- Imported goods

- Motor fuel

- Cigarettes

- Airline tickets

- Phone service

Steps To Pay Excise Duty

With the help of the Electronic Accounting System in Excise and Service Tax (EASIEST), the payment gateway of CBEC, paying excise duty can be straightforward. Follow these steps:

Step 1: Start by visiting the EASIEST portal.

Step 2: Enter your Assessee number.

Step 3: Provide your personal details.

Step 4: Navigate to the tax-type menu and choose the code for excise.

Step 5: Select your financial institution.

Step 6: Verify the shared information.

Step 7: Log in to the net banking gateway.

Step 8: Enter the tax amount.

Step 9: Complete the payment.

Step 10: Verify the payment status.

People often mistake excise duty with other forms of taxation, including customs duty. To guarantee correct charging and treatment, taxpayers should educate themselves beyond the definition of excise duty. Accurate tax administration, for instance, depends on knowing the basic differences between GST and excise tax—that is, between excise duty and customs duty.

Also, according to a report, paying taxes has become much easier with the implementation of GST in India. When GST went into effect on July 1st, 2017, it united the markets of all the states and union territories. In general, GST is expected to improve India’s economic efficiency and growth year by year. Know more about the success of GST in India. However, to learn more about GST, check out its advantages and disadvantages in India. This will enhance your understanding of taxation in India.

Key Takeaways

The government imposes excise taxes on specific commodities and services, which are first paid by the manufacturer or producer of the goods. Excise taxes might also only apply to items sold in the state where the taxing authority is located.

Knowing the several excise tax categories makes it easier to understand how they affect our daily lives and economy. Recall that excise taxes support public services and promote good behavior behind the scenes the next time you purchase petrol or a luxury good. Understanding these taxes might help you make wise choices and value their importance in our community.

FAQs

Are excise taxes the same as customs duty?

Excise duty, an indirect tax levied by the Indian government on product producers, is the reverse of customs duty in that it applies to items produced domestically in the nation. In contrast, customs duty is collected on goods entering the country from outside.

What is a Direct Tax?

A direct tax is one that an individual or group pays the body that levied it directly. Examples are individual taxpayers paying the government directly for income tax, real estate tax, personal property tax, and asset taxes.

Who are excise taxpayers?

Two parties are required to pay excise tax in India: First, it is paid by the manufacturer or producer of the goods, and later on paid by the consumers indirectly.

How does excise tax differ from GST?

While GST is a broad-based consumption tax applied to most goods and services and charged at each stage of production and distribution, excise duty is collected on particular products like fuel and tobacco. It is usually included in the price of the good.

What is the penalty for not paying excise duty?

Ignoring excise tax on a good whose duty charge exceeds INR 50 lakh might lead to imprisonment for up to seven years and a fine, with or without, depending on the situation.

What is an excise?

An excise (or excise duty) is a tax on goods made and sold within a country. Unlike customs duties, which are for goods coming from other countries, excise taxes apply to the production or sale of products within the country.