The GST Portal is the official website of the Indian government for GST filing, GST registration, GST refund monitoring, complaints, notices, and other GST-related compliances and information.

Any taxpayer who wants to file a goods & service tax GST login details, GST login return, request a refund, or reply to a notification has to have a working GST login on the GST system.

In this blog, we will look at the GST login portal, services that are available before and after the GST login, how to obtain a GST login, and how to log in to the GST site successfully. If you are looking for one platform that solve all your GST work than go for GST Prime.

Also Read:- Check & Download GST Filing Status

What Is GST Portal And Its Importance?

A PAN-Indian government website for GST compliance is called GST login Portal. The URL of the GST government portal is https://www.GST.gov.in. A taxpayer can do all of the GST compliance tasks via the government portal, both before and after logging in.

They may use the GST login page to do things like register for GST, file returns, pay taxes, request refunds, and more, as detailed in later sections of this article.

Also Read :- Everything You Need to Know About Jurisdiction of GST State Code List

How Can I Sign Up for The GST Portal?

- Go to the official website for GST.

- Select “Services.”

- Select “New Registration.”

- Enter your email address, PAN, state, district, and legal name of the company.

- Click “Proceed.”

- Check by sending an OTP to the registered mobile number.

- Obtain a TRN, or temporary reference number.

- Return to the GST site and input the TRN.

- Edit the application and attach the necessary files.

- Carefully follow the on-screen directions.

- Choose ‘Verification’ after finishing.

- Use the GST reference number to check the progress of your application.

GST Portal Login (www.gst.gov.in) Before Logging in

Logging in to GST portal login grants access to a number of services and features that were previously unavailable. These pre-login services are beneficial to users who want to browse the site or obtain specific information without logging in. Some of the most important pre-login services provided by the site are as follows:

| Search Taxpayer: By entering their name, GSTIN, or state, you can use this tool to look up the GSTIN details of any registered taxpayer. |

| Search HSN/SAC: You can use this function to search the Harmonized System of Nomenclature (HSN) or Service Accounting Code (SAC) for goods or services by typing relevant terms. |

| FAQs: The website offers a comprehensive list of Frequently Asked queries (FAQs) spanning a range of topics in order to provide users with quick answers to frequently asked queries. |

| Taxpayer Services: You can access a number of taxpayer services, such as tracking the status of applications, filing complaints, and updating email addresses and mobile numbers, by checking in beforehand. |

| Quick Links: The website provides quick access to key documents, including statutes, circulars, and GST-related regulations. |

| News and Updates: Stay up to date on the latest GST-related news and updates by using the website’s GST login. |

Important Steps To log in GST portal

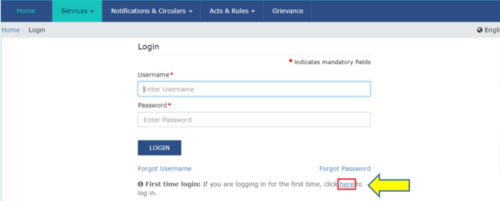

Step 1:- Go to the GST website (www.gst.gov.in)

Navigate to the GST website and click the ‘Login’ option in the upper right corner.

Step 2:- Login for the first time

After clicking ‘username,’ you’ll see a screen with username and password boxes.

If this is your first time logging in, scroll to the bottom and click the ‘First Time Login’ button. Click on it.

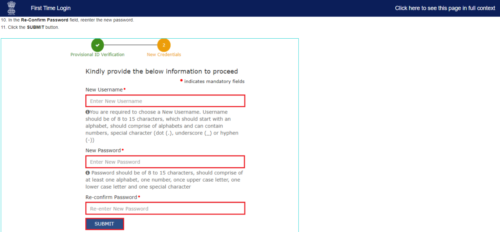

Step 3:- Obtain login information

Check your email inbox for the GST Department’s credentials.

The email will include your login and GSTIN. Enter your GSTIN in the username field. Enter your name as the password in the designated password field.

Also Read:- GST Express Software – Key Features & Benefits For MSMEs

Step 4:- Log in

A new screen will open once you’ve entered your login information. You can proceed if your login and password are correct.

To proceed, the user must provide the following information:

Create a username with eight to fifteen characters, allowing for special characters and numerals after the initial letter. Along with having a minimum of one number, one uppercase letter, one lowercase letter, and one special character, your password should include eight to fifteen characters.

Make sure your new username complies with these security requirements. It needs to start with a letter and be a distinctive mix of letters, numbers, and special characters.

The password must be at least one character long, contain a combination of alphanumeric characters, and have a unique security symbol. Following these recommendations guarantees a robust and safe account setup.

How Can I Check My Status Under GST?

| To access your account, go to the official GST login Portal website and enter your login details. |

| The dashboard option will appear on the home screen following a successful GST login portal. |

| By logging into this dashboard, you may easily check the return status for the last five return periods, including whether or not they have been submitted. |

| The dashboard makes it easier to navigate the site by giving you quick access to important components like your orders, notifications, and profile with just one click. |

| This dashboard allows you to file returns and generate tax payment challans promptly, making it simpler for you to fulfil your tax obligations. |

Conclusion

The GST Portal is a vital tool for accelerating tax compliance and administration in India. Whether you are registered or not, you can use the site to examine ledgers, pay taxes, make payments, and receive refunds, among other things.

With its state-of-the-art features and straightforward procedures, the GST Portal enables individuals, businesses, and tax professionals to confidently and successfully manage the complexity of the Goods and Services Tax.

FAQs

How to change email id in GST portal without login?

Here are few steps to change email in GST Portal

- Log in to the GST website. Click on Services, then Registration, and choose Amendment of Registration Non-core Fields.

- Click on the tab for the authorised signatory. Press the ‘Add new’ button.

- Fill in the details for the new authorised signatory, including their email address and mobile number.

How to check GST return status without login?

No, you cannot view additional orders/notices without login on the GST Portal.

How do I know my GST login ID?

Here are few simple steps to know your GST Login Id.

- You will see the GST Home page.

- Click on the Login link at the top right corner of the GST Home page.

- The Login page will appear. Click on the Forgot Username link below the LOGIN button.

Is it possible to activate GST if it got suspended?

Yes it is possible to activate GST if it will get suspended. Here are few ways discussed in the article.

How to use GST portal for registration?

To register on the GST portal for GST registration

- Visit the GST Portal: Go to www.gst.gov.in.

- Select “Services”: Click on Services > Registration > New Registration.

- Fill Part A: Enter details like PAN, mobile number, and email ID. Verify using OTP.

- Complete Part B: Provide business details, upload documents (proof of business, identity, and address), and submit the application.

- ARN Generation: After submission, you’ll receive an Application Reference Number (ARN).

- Verification: The application will be verified by GST authorities.

- GSTIN Issued: Upon approval, you’ll receive your GSTIN (Goods and Services Tax Identification Number).

How to login GST portal without username and password?

You cannot log in to the GST portal without a username and password. However, you can access some services like searching for GSTIN/UIN details, tracking GST payments, and checking application status directly from the “Search Taxpayer” or “Services” section on the GST homepage. For login-related issues, use the “Forgot Username/Password” option to recover your credentials.

Write a short answer of How to login to GST portal for first-time users?

To log in to the GST portal for the first time:

- Visit the GST Portal.

- Click “First-Time Login” on the login page.

- Enter your Provisional ID and Temporary Password (sent by GST during registration).

- Create a new username and password.

- Log in using the new credentials to complete your profile setup.

What is www.gst.gov.in login dashboard?

The www.gst.gov.in login dashboard is the online interface provided by the Goods and Services Tax (GST) portal for registered taxpayers in India. After logging in with a username and password, users can:

- File GST returns (GSTR-1, GSTR-3B, etc.).

- View or download payment and return details.

- Generate e-invoices or e-way bills.

- Track notices, applications, and refunds.

- Update profile and contact details.