The Increasing Significance Of Decoding Credit Scores

You would have come across emails in your inbox, with the subject “find your credit score for free” and so on. If you’re like most people, then you would have probably tossed that email into the trash, without giving it a second thought.

In fact, a majority of people don’t bother checking their credit score, unless they are applying for a bank loan or a credit card. What ’s shocking is–many people, don’t bother checking their credit ratings even while applying for a financial product like a loan.

Why Do People Ignore Their Credit Scores?

One, it isn’t a number that impacts your daily routines — like your bank account balance or your weight. So, it becomes easy to neglect.

Two, there are plenty of myths about credit scores. Some people falsely believe that by checking their credit scores, they run the risk of lowering it. This is a complete myth and needs to be put down. When you check your credit score, you’re making a soft inquiry, which in no way, impacts your credit ratings and the score.

Now, that we’ve cleared the air, let’s take a look at the reasons,

Why Decoding Your Credit Score Is Becoming More And More Important?

1. It helps You Know Where You Stand

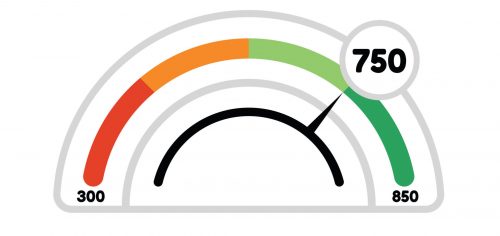

Your credit score is an indicator of your overall financial health. Just like you keep a tab on your weight, blood sugar levels, BP to monitor your physical health, you need to check your credit score to keep your financial health in control.

Irrespective of whether the number is poor or good, you need to know it. The good news is that — once you know where you stand, you can take the right steps to improve it.

2. It Helps You Boost And Maintain Your Score Over Time

Remember, in school and colleges; you would study the entire syllabus on the eve of the exam and ace it? Well, credit scores don’t work that way.

You cannot boost your credit numbers overnight. It takes months and even years to build the numbers. By decoding your credit score, you can take the right steps to boost it gradually.

Also Read: Business Loans: When Credit Scores Don’t Matter

3. Helps You Rectify Errors

By decoding your credit score, you can find out whether your credit reports are accurate. For instance, you may have paid off a loan, but if your credit report doesn’t reflect it, it may be the reason for your poor credit numbers.

By tracking and monitoring your credit score, you keep your credit reports accurate and up to date.

4. Helps You Land Better Deals

This is one of the biggest reasons to monitor and track your credit score. When you know your credit score, it gives you the upper hand in your negotiations with lenders. Lenders often offer lowered interest rates to people with higher credit scores.

By knowing your credit scores, you can use it as the trump card in your negotiations while applying for a loan or credit card. Even 1% reduction in the interest rate, could reduce your loan burden significantly.

Also Read: 5 Pro Recommendations To Fix A Poor CIBIL Score

Where To Check Your Credit Score?

Earlier you had to pay to get your credit report and score. But, post-2017, the RBI has made it easy for people to check their credit scores. Today, you can apply for your credit report at a credit bureau for free. Alternatively, several online Fintech firms also provide your credit report for free.

Keep An Eye On Your Credit Score & Be In Control

Given the increasing importance of the credit score, make sure to monitor it regularly. And, if the numbers are low, work on improving them. And, for those with high ratings, make sure you maintain it. Even if your credit score is not high, don’t fret. You can always explore loans from digital lenders like Indifi and give wings to your personal and well as business goals.

Apply For Finance For Business In India