A GST business loan credibility is determined by the lender based on the GST returns filed by your business. The audited financial documents, such as the profit and loss statement and balance sheet, are thoroughly reviewed, and the loan is immediately approved. Get details of how to create a perfect balance sheet for your business.

Small business finance is an important economic growth engine. A new generation of entrepreneurs is flexing its entrepreneurial muscles in industries such as manufacturing, services, and retail. Attractive interest rate and tenure durations are the primary distinguishing features of various business loans.

GST Business Loan for MSMEs

Infrastructure expansion is critical to guaranteeing the long-term viability and profitability of small-scale industries. The GST loan scheme can be used to fund expenses such as brand visibility increase, operational process innovation, and human resources. GST Prime Loan Scheme is one of the newly launched scheme that help MSMEs to grow.

Enterprise operating cycle efficiency should be maintained at a competitive level, and GST business loans provide the essential initial impetus to drive the profit quantum of the industries. Fund structuring is a critical aspect in staying ahead of the competition for attractive interest rates.

According to a recent McKinsey poll, the majority of medium and small businesses base their annual financial decisions on lower borrowing terms. GST business loans are extremely beneficial in attracting top personnel from the local community and enhancing business efficiencies in the eyes of global investors.

Who Can Apply for GST Business Loans?

The loan is only available for business purposes, as the name implies. A GST based loan is available to private limited companies, public limited companies, partnership firms, and sole proprietorships. Do you know? There are 7 types of company registration in India check now.

Furthermore, the interest rate on GST loans may vary from one business profile to another depending on the nature of your business, previous credit history, and GST return amount.

Important Considerations for Credit Collateral

The interest rate on a business loan secured by GST is quite low. The MSME sector’s cash credit demands can be satisfied without the necessity for pledging land assets and other important collateral to get loans.

The loan amounts can range up to Rs 1 crore, depending on the quality of the individual firms’ GST reports. The link between GST returns and corporate working capital requirements is directly proportional.

In this post-covid world, obtaining effective finance terms is one of the defining criteria for the global accessibility of MSME firms’ products.

The marketing, operations, and business growth departments’ strategic efforts will be dependent on sustaining appropriate working capital needs. One of the distinguishing qualities of a GST loan is the absence of collateral, which allows business owners to relax and reinvest their money in infrastructure growth.

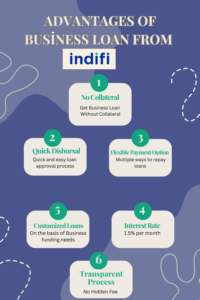

Advantages of Obtaining a Business Loan from Indifi

When it comes down to the advantages of obtaining a business loan from Indifi, the list is a long one. Some of the most common benefits include:

No Collateral

Indifi offers a simple online loan application process that requires very few documents and ensures fast loan approval. We use advanced algorithms to check your profile, so there’s no need for you to provide any collateral. This means you can get a business loan without putting up any assets, helping you meet your immediate financial needs.

Quick Disbursal

We offer a quick and easy loan approval process. When you apply for a business loan, it gets processed in just 48 to 72 hours, with loan amounts of up to INR 1 crore.

Flexible Payment Option

For small businesses looking for flexible ways to repay loans that fit their needs, Indifi offers repayment options with low-interest rates starting at 1.5% per month. Businesses can also get quick access to loans by applying with Indifi.

Customized Loans

There isn’t a single loan solution that works for every business. Indifi offers customized options by working with various lenders to meet the changing funding needs of each company.

Interest Rate

The interest rate for business loans starts low, beginning at 1.5% per month. However, borrowers also need to pay a processing fee, which can be up to 4%.

Clear Process

From applying for a business loan to paying your EMIs, everything at Indifi is done online. This way, you won’t encounter any hidden fees during the loan repayment process.

Eligibility Requirements for a GST Business Loan

The GST loan eligibility criteria differ from lender to lender, but are often based on the following scheme:

Registration for GST

The borrower must have a valid GST Registration Certificate and follow the rules outlined in the Goods and Services Tax (GST) laws.

Business Profile

Lenders typically offer GST-based loans to enterprises engaged in manufacturing, trading, or the service sector.

Business Vintage

Each lender has different standards for Business Vintage, however all need a minimum of one year for business vintage.

Turnover Is Kept To A Minimum

Lenders typically establish a minimum turnover or sales criteria when issuing a Business loan based on GST, which may be for more than one year to ensure sales consistency.

Age Of The Applicant

Lenders typically have a threshold and an age ceiling for the borrower, with the minimum age starting at 21 years and the maximum age reaching 65 years at the end of the loan tenure.

Conclusion

Many financial institutions in India provide business loans, but many firms still struggle to obtain one due to a variety of obstacles, including insufficient collateral and documentation. Things worsen for someone looking to establish a business.

The GST based loan comes in handy in this situation. You may simply develop your company and satisfy its other financial demands with the aid of this business loan.

FAQ

How to get a business loan on GST certificate?

With a GST loan, you need to show your official GST returns and have the essential identification of documents. You can get the loan without offering any assets as security.

What is the limit of a GST loan?

A GST business loan is a type of loan where micro, small, and medium-sized businesses can borrow up to Rs. 50 Lakh. The loan amount is determined based on the business’s GST returns.

What is GST Surrogate Business Loans?

A GST Surrogate Business Loan is a financial product designed for MSME business owners, allowing them to secure funding based on their GST history. If you are an MSME entrepreneur with at least two years of GST records, this loan would be an ideal option for your business.

Who can get a MSME GST loan?

MSME units involved in trading, services, or manufacturing, no matter their type, that have been in business for at least one year can apply. The MSME unit or borrower needs to have valid GST returns. For regular GST returns, they should have filed GSTR-1 for at least the last 3 months, and for composition returns, they should have filed GSTR-4 for the latest quarter.

What is GST Surrogate?

A GST surrogate refers to an alternate or substitute indicator used to estimate GST-related trends, such as revenue, compliance, or economic activity, when direct data is unavailable. It can include metrics like e-way bills, tax filings, or other financial indicators related to GST operations.