Obtaining a low-credit business loan may seem like a difficult task: however, it is not impossible. Most of the small business owners often face the challenge of withholding good credit because their businesses do not reflect the same. No need to be ashamed of asking this question. In the current post, we will consider how entrepreneurs with under-credit can still obtain funding, what variants may be used, and how one can increase the possibility of being approved.

What is an Unsecured Business Loan?

An unsecured business loan refers to a financing scheme that is not secured. This implies that you will not need to deposit an asset such as a house, or cars, or machinery to secure the loan. As a lender, your credit status, cash flow and general business performance are the determining factors and not physical security regarding business loans.

Since such loans are more risky to the lender, the approval terms may be more stringent than in the case of secured loans. They are however perfect to those entrepreneurs who do not need to risk losing assets or they do not have sufficient security to place.

What Is the Importance of a Credit Score?

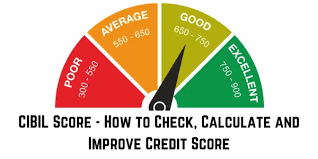

Your credit score is a number that displays the level of your trust in being a borrower. It helps lenders to make a guess on the quality of borrowing you will pay back a loan. An excellent score indicates that you have been a good manager of debt in the past and so on. A poor score might want to send up a red flag.

In case of an unsecured loan, the credit score is even more critical since the money lent does not have a physical asset to be reclaimed on your default. With that said, the lenders know that credit scores are incomplete as well particularly to new businesses or businesses rebounding after some economic setbacks.

Is it possible to obtain a loan with a poor credit score?

Of course you can. Whereas a low credit may not grant an applicant a good chance to use traditional banking, the other lenders or fintech platforms have climbed up with relaxed requirements to join. Such lenders also take into account other aspects, including how much money you make each month, how long you have been in the business and what kind of business.

It is possible to find a number of online lenders whose specialties lie in the area of work with small businesses with poor credit. They consider the cash flow, digital transaction records or reviews of your business activity as an indication of whether your business is whole or not. Such alternative methods give opportunities to many business owners who could otherwise fail to qualify.

What is a Low Credit Score?

A low score is at least less than 600 in most of the cases. Most conventional lenders want scores of 680 and upward whereas a large part of alternative loan providers service scores between 500 and 600. You could actually be looking at as low as 500 on the scores but it all depends on the other parts of the application.

It should also be indicated that in the case where the amount of your credit is below 600, another financial profile that shows characteristics of your other finances would cushion against the risk. When your company has a stable income flow, little current debt and a bright prospect to the future, your approval possibilities are raised greatly.

Which are the Kinds of Lenders that Deal With the Low Credit Borrowers?

Your best bet is alternative and online lenders. These are peer-to-peer lending, micro-lending institutions, merchant cash advance, and business loan companies in the form of fintechs. They are prone to employ sophisticated algorithms and data-topological models, which consider your credit report beyond scope.

These lenders usually concentrate on the performance of your business together with its everyday running. Such as in the case of the lack of perfect credit as an example when your sales are regular, and you have a loyal customer, a lender will be happy to provide funding.

What Else Do Lenders Use to Evaluate Risk?

Lenders know that there are numerous factors that can affect credit scores, not all of which can be permanent or controllable by you. This is why they tend to inspect your bank account records, business income and payment records to the suppliers or vendors.

Other lenders too may look at your business plan and how you will utilize the loan. Lenders might think you are a good investment especially in case you are able to show clearly how the funds will bring in more revenues or help you to become financially stable.

What Loan Options Can I Have?

There are various unsecured loans that can be considered by low-credit borrowers. Short term business loans, which tend to be charged higher rates of interest and repayable in shorter terms, provide immediate money. Business lines of credit allow flexible use of money, and only a soft credit check can be taken.

Invoice finance is an alternative, in which the invoices that you have outstanding act as security of repayment deposit-this has no effect on your credit. Even though they are more costly, merchant cash advances offer immediate funds, which are exchanged with a percentage of future sales.

Does Better Performance on Other Financials Make a Difference?

Yes, absolutely. Despite low credit score, high cash flow, great monthly revenue, and low debtors could provide a great benefit to your loan application. Lenders would also like to know that your business would generate sufficient incomes to make repayments.

Maintaining a good balance in the business bank account, maintaining spending in good vendor relationships but paying them on time, having a set of separate accounts for personal and business finances are good resources to display a trait of financial discipline. Although it records low scores, these practices portray your business as credible in the perspective of lenders.

Does a Loan Have the Potential of Boosting Your Credit Status?

Yes, as long as it is managed well, a loan obtained with a low score can help you to build up or rebuild credit. Paying on time and consistently will tell future lenders about your capability of dealing with debt.

Some lenders also report to business credit bureaus, which makes you build a stronger business credit profile. With time, it may lead to superior terms, bigger loan size and longer repayments.

Conclusion

With a low credit score, it might take you a little more effort to get an unsecured business loan; however, it is indeed possible to have the loan with the right approach. Did you know that many lenders are switching beyond the traditional credit scoring in order to work out the bigger picture of your business health?

Through good financial management, selection of the right lending partner and openness in your application, you will be able to prevail over the issue of credit to access the funds that will support your business growth.

A low credit score is not supposed to come in your way to achieve your business. Lending is changing, and never has there been a greater variety of lending options that are accommodative to everyone.

FAQ

Q1: What should be the credit score requirement when applying for an unsecured business loan?

Although conventional lenders ask that you have a score of 680, a good number of online or alternative lenders will give you a loan with as low as 500, based on the amount of revenue and financial strength your business generates.

Q2: Would applying on a loan damage my credit rating?

Soft credit inquiry does not impact your credit score. However, a hard inquiry, which is usually conducted prior to final approval, may temporarily decrease your score by a couple of points.

Q3: Is it possible to take a business loan without collateral or personal guarantee?

Other lenders can provide unsecured loans, just not using a personal guarantee, although such loans are often more stringent, interest-costly, or lower-violated-funds.

Q4: Can I get a business loan if my CIBIL score is low?

Yes, you can apply for a loan if your CIBIL score is low. Your credit score can be in the range of 500-680 to get a business loan.

Q5: What is the maximum amount of unsecured business loan?

The maximum amount for an unsecured business loan is up to INR 75 Lakhs. However, this amount might vary depending upon the lending company.