There are several ways to get a company loan. Lenders offer customized loans for both small and large businesses, even though an individual can obtain a gold loan for commercial purposes or a basic plain personal loan.

In general, there are two categories of business loans: secured and unsecured. If the former, the

the company owner must make sure there is some kind of security that the loan is given against. This could be equipment or other valuable assets, or it could be an office building that the company owns.

What Is a Credit Score and Why Does It Matter?

When you need to apply for this loan, knowing how important your money value is will help you apply for finance for your company successfully. Since these loans typically don’t demand a defined or guarantee item, lenders view them as riskier and place more value on your credit score when granting your loan. This blog covers the significance of your credit score, how it affects your loan application, and what you can do to raise it.

Minimum Credit Score Required for Unsecured Business Loans in India

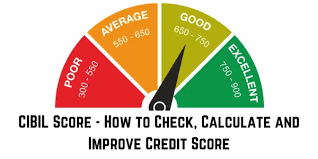

Using information from your credit history, a loan score is a numerical assessment of your ability to repay debt. A higher score indicates a better credit risk. Typically, scores fall between 300 and 850. This data, which is compiled by major credit bureaus, takes into account things like:

- Payment History: Your score is improved if you consistently make on-time payments.

- Credit utilization: Reduced credit utilization is ideal. This is a mix of credit available to what is used.

- Credit History Length: Generally speaking, a longer credit history raises this particular score.

- Credit Account Types: A variety of these, including loans and cards, can raise your score.

- Recent Inquiries: Too many inquiries could be a sign of increased risk, which would lower your score.

How Credit Score Affects Loan Amount, Interest Rate & Approval Speed

- Consideration of Lender Risk

Lenders find it more difficult to approve unsecured loans because there is no collateral that can be seized in the event of a borrower default. Lenders therefore use credit scores widely to determine the level of risk involved in making a loan to a firm. A high credit score denotes a lower risk and suggests that the borrower would probably make timely loan repayments. On the other hand, a low score raises suspicions and demands more investigation or flat rejection.

- Rates of Interest and Charges

Lender interest rates are heavily influenced by your credit score. Higher score earners usually receive reduced interest rates, which can add up to significant savings over the course of the loan. For instance, thousands of dollars in interest payments over a number of years can be charged by a difference of just a few percentage points. Lenders may also impose greater costs or demand more guarantees from borrowers with bad credit.

- Loan Amount and Conditions

Based on the applicant’s credit score, lenders frequently place limits on the maximum amount they will provide. A strong credit history can lead to higher loan amounts in addition to a higher chance of acceptance. Additionally, companies with higher scores might be given better terms for repayment, such longer repayment periods or less monthly payments, which would relieve some of the burden on their cash flow.

- Speed and Process of Approval

Loan acceptance can happen more quickly if your credit score is high. When a borrower has a good history, the lender may simplify the application process and speed up the funding process. For companies who require quick cash for operating costs, goods deals, or emergency bills, this is especially important.

- Having Access to Additional Lenders

Your possibilities for lenders are increased with a high praise score. Credit scores are a major qualifying factor for many alternative lenders and financial institutions. You’ll be able to choose from more financing options with a strong credit score, including alternative lenders who might provide better rates.

Risks of Low Credit Score for Business Loan Applicants

It may be difficult to obtain an unsecured business loan if your money value is below average. Lenders have the option to approve your application subject to strict requirements or to reject it completely. A low score can result in the following situations:

- Higher Interest Rates: Lenders raise this to cover the added risk, which drives up the total price of your loan.

- Restricted Loan Amounts: Your business may not need the larger funds.

- More Collateral: Lenders may demand personal guarantees or more assets which would go against the intent of an unsecured loan.

- Extended Approval Periods: Due to lenders’ thorough examination of your application, the review procedure may take longer.

Tips to Improve Your Credit Score Before Applying for a Loan

Considering how important this aspect is, you should work to improve it, particularly if you want to apply for an unsecured business loan:

- Examine Your Credit Reports: Get regular reports on your fund from the three main reporting agencies. Search for any mistakes or inconsistencies and, if needed, challenge them.

- On Time Bill Payment: Your credit score is greatly improved by making on time, consistent funding on loans, credit cards, and other debts.

- Lower Credit Usage: Try not to use more than 30% of your credit. Your score can be raised by paying off current bills.

- Aim to Avoid Opening New Accounts Before Applying: Don’t apply for a loan right before obtaining fresh credit.

- Create a Diverse Credit Profile: Having a variety of these kinds, such as instalment loans and revolving credit, might improve your score if it is practical.

- Create a Solid Business Credit Profile: Building such a portfolio can be beneficial in addition to your personal credit.

Conclusion

Lending is, above all, based on your credit score for an unsecured business loan. This factor will influence the terms and interest rates but also whether you’ll qualify for the loan. You will increase your chances of getting the financing that will help you grow your business by coming to appreciate just how important your credit score really is then taking bold moves to raise it. Therefore, a good credit rating for your business will give it the capital flexibility to stay within the competitive market, besides making it easier to receive funding.

FAQs

- What is the minimum credit score required for an unsecured business loan in India?

Most lenders in India prefer a CIBIL score of 650 or above for unsecured business loans. However, NBFCs and fintech lenders may consider applications with scores around 600–650, depending on business turnover and repayment capacity. - Why is credit score important for unsecured business loans?

Since unsecured business loans do not require collateral, lenders rely heavily on your credit score to assess repayment ability. A higher score reduces perceived risk, improves approval chances, and helps you secure better interest rates and higher loan amounts. - Can I get an unsecured business loan with a low credit score?

Yes, but it can be difficult. With a low credit score (<600), lenders may:

* Offer smaller loan amounts

* Charge higher interest rates

* Ask for personal guarantees

To improve your chances, work on repaying debts on time and reducing credit utilization before applying. - Does a good credit score affect loan interest rates?

Absolutely ✅. Borrowers with high credit scores (700+) usually qualify for lower interest rates because lenders see them as low-risk. On the other hand, lower scores often mean higher rates, increasing the total cost of the loan. - How can I improve my credit score before applying for a business loan?

You can boost your credit score by:

* Paying EMIs and bills on time

* Keeping credit card utilization below 30%

* Avoiding multiple loan applications at once

* Checking credit reports regularly for errors

* Maintaining a mix of credit (cards + loans) - Does my personal credit score affect my business loan eligibility?

Yes. For small businesses and startups, lenders often check the business owner’s personal credit score along with the business credit history. A strong personal score increases approval chances and loan limits. - What happens if I default on an unsecured business loan?

Defaulting negatively impacts your CIBIL score, making it harder to secure future loans. Since there is no collateral, lenders may pursue legal action or seek repayment through personal guarantees if provided.